Interesting "big picture" article in the Economist regarding retail trends in an online & multi-channel universe - definitely worth read.

Here's a few snippets of interest to online retailers.

"It is tempting to conclude that shops are to shopping what typewriters are to writing: an old technology doomed by a better successor. " It quotes Marc Andreeson: "Retail guys are going to go out of business and e-commerce will become the place everyone buys. You are not going to have a choice.”

"When shoppers both know what they want and are willing to wait for it they will go online. "

"Shopping is about entertainment as well as acquisition. It allows people to build desires as well as fulfil them—if it did not, no one would ever window-shop. ...Last year online sales of shop-based American retailers grew by 29%; those of online-only merchants grew by just 21%. Apart from Amazon—which has long spurned profits in favour of growth—most pure-play online retailers are losing market share, says Sucharita Mulpuru of Forrester Research."

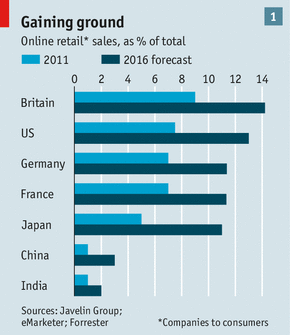

"Britain may be one of the places where the future of retail is most easily seen. Online shopping has advanced further there than in other developed economies. The population is quite tightly packed, which makes delivery relatively cheap, and 70% have broadband internet access...Footfall on British high streets has declined for seven years running. Citi Research, part of Citigroup, a bank, calculates that comparable sales at a representative selection of Britain’s clothing chains fell by 3-5% a year between 2009 and 2012. Shop rents are high and leases are long, which piles on the pressure. Vacancy rates have risen fivefold to 14% since 2008. A report by the Centre for Retail Research predicts that a fifth of Britain’s high-street shops will close over the next five years, eliminating more than 300,000 jobs."

"Between 15% and 20% of sales at Dixons are online, depending on the season, and the proportion is rising. But Dixons thinks the advantages which online-only merchants get by doing away with shops and sales staff are undercut by the need to pay more than high-street shops do to acquire customers (largely by paying Google for clicks on adverts) and to spend a lot on shipping."

"Deep personalisation could have disruptive consequences. Retailers are beginning to see profit per household, rather than per square metre."

"All retailers are competing increasingly with suppliers seeking new direct routes to market. Last year online sales by companies that make their own products grew faster than those of both shops and online-only retailers in America."

[Source: The Economist}