Contents

Download the PDF now.

Based on research covering product discovery, on-site search usability, real-time results, natural language processing and recommendations on eCommerce websites.

Do you remember “Ask Jeeves”? Way back in 1996, the search engine encouraged users to phrase their queries in the form of a question. The concept was ahead of its time. Twenty years, in fact. It wasn’t until 2015 that Google launched its truly conversational updates to enable conversational searching, allowing users to get more relevant results when using natural language ...

Do you remember “Ask Jeeves”? Way back in 1996, the search engine encouraged users to phrase their queries in the form of a question.

Truly innovative product discovery technology has been the privilege of tech giants such as Amazon and Google for too long. Retailers spend so much money getting shoppers to their websites, only to haemorrhage much of that

investment by offering a suboptimal shopping experience.

The research in our Ecommerce Discovery Index confirms that a majority of websites are not prepared for the next phase of conversational commerce.

This UK edition covers 50 retailers, 40 criteria, and one mission to simplify product discovery for shoppers (and retailers).

The research and report is meant to help retailers identify areas for improvement in their eCommerce discovery journeys and technologies. Klevu carefully considered the criteria to include in this research and consulted various eCommerce experts during the process. James Gurd, eCommerce consultant and co-founder of the re:platform podcast with Paul Rogers, had significant input and we wanted to publicly thank him for his guidance.

The Klevu eCommerce Discovery Index includes criteria on search, product discovery and website usability. Within the search criteria, we consider the placement of the search box and whether or not it contains clear instructions for the scope of search and discovery. We look into voice and image-led discovery capabilities, the presence of type ahead search (also known as search-as you type or search overlay) on desktop and mobile devices and what kind of content is displayed within the type ahead functionality.

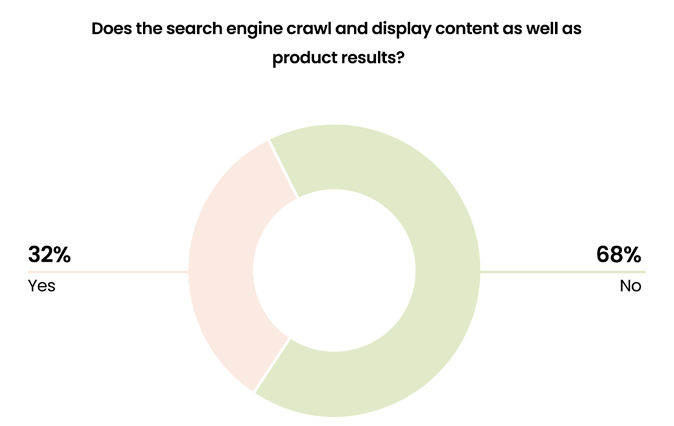

We determine whether or not the search engine crawls and displays content as well as product results. We research whether or not a website search engine and/or search overlay can handle search by SKU, misspellings, and successfully process various types of natural language queries containing brands, attributes, price, and more. We look into the zero results experience to see how well the websites signpost back to product. In addition, we review website usability, specifically the presence and relevancy of filters on category and search results product listing pages, and to what extent a website displays contextually relevant marketing banners on product listing pages.

Conversational product discovery is now expected by shoppers. Voice-led technologies such as Amazon Alexa and Google Home are turning ‘zero UI’ interactions into ubiquitous experiences. Gartner once predicted that by 2020, 30% of our browsing sessions would be voice conducted. This is extending naturally into commerce and retailers need to be ready. Quoracreative found that 62% of those who regularly use their voice-activated speakers are likely to buy something through the device.

Quoracreative found that 62% of those who regularly use their voice-activated speakers are likely to buy something through the device.

Conversational queries are complex and can also include words which denote sentiment, such as ‘best women’s top on sale’. As voice search becomes more and more prevalent in shopper behaviour, natural language queries such as this will require relevant results. And retailers not able to offer that will suffer. A sophisticated discovery engine is able to not only handle misspellings, process natural language and interpret intent, but also augment product catalogues with synonyms and sentiment and learn over time from shopper behaviour.

Voice search was only signposted on one retailer’s website, Cox & Cox. Many people may choose to use voice search over text search for a variety of reasons, accessibility being one. Whether or not it is signposted, on mobile devices voice-led search is common and available for use. If a retailer's website search engine can't parse natural language, it creates a suboptimal experience and accessibility issues.

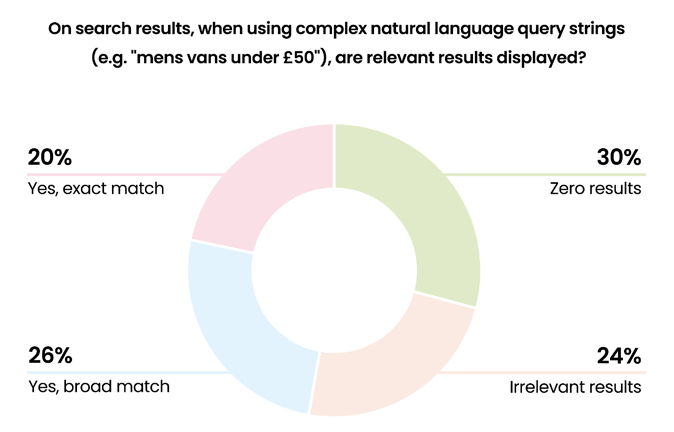

In our research, a shocking 78% of retailers were unable to display exact match results when faced with complex natural language search terms. 30% returned zero results and 24% returned irrelevant results. Fashion retailers performed worse in this area than non-fashion, with 42% of fashion retailers displaying zero results and only 15% of non-fashion.

In the research, we used this example tailored to each website’s offering -- ‘blue jacket for women under £100’. In this example, ‘jacket’ is a noun and the main subject of the query. ‘Blue’ and ‘£100’ are attributes, ‘women’s’ is a category and ‘for’ and ‘under’ formulate the intent of the shopper and give an idea of the results they expect to see.

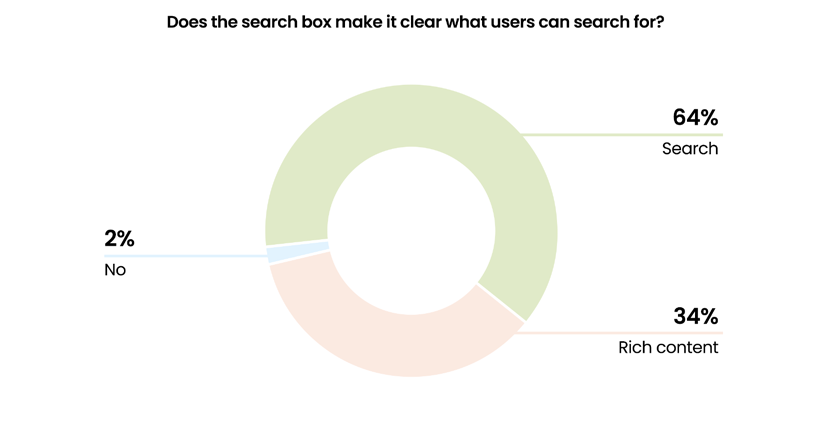

A vast majority of retailers’ websites (64%) don’t make it clear what shoppers can search for, instead displaying a generic ‘search’ text in the search box.

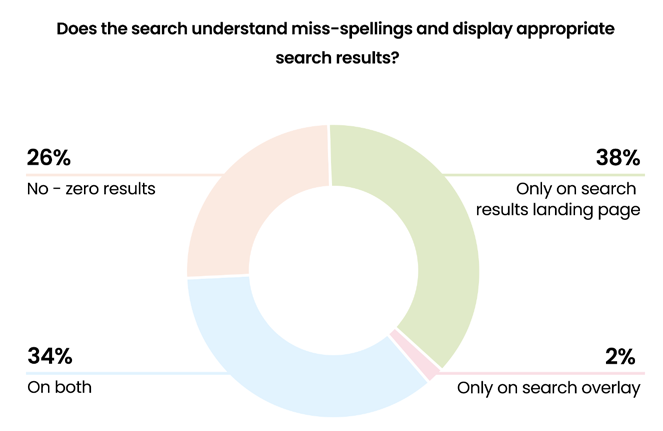

When it comes to misspelling only 34% of retailers’ websites were able to display relevant results for misspelled words on both the search overlay and search results pages. 38% of retailers were only able to process misspellings on the search results pages after a shopper submitted the search query, and 2% of retailers were able to show relevant results on the search overlay but not the search results. 26% of websites we researched couldn’t process the queries at all and returned zero results. Ironically, a search for ‘chocolate’ on the Hotel Chocolat website returns zero results.

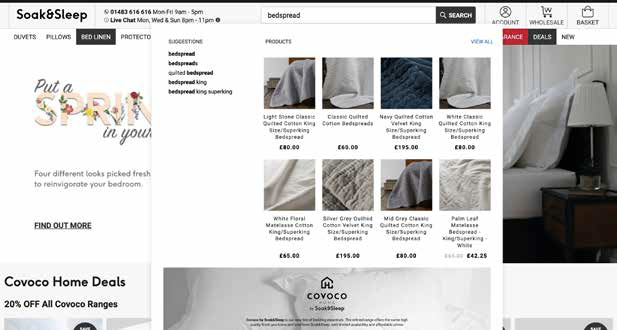

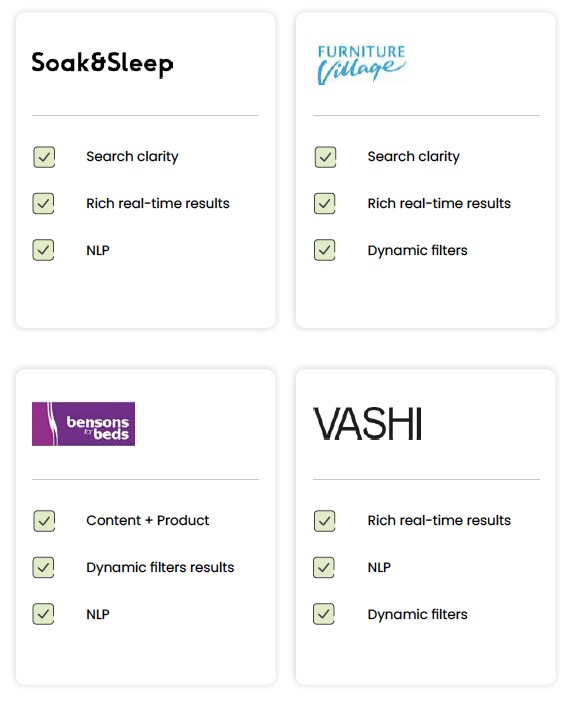

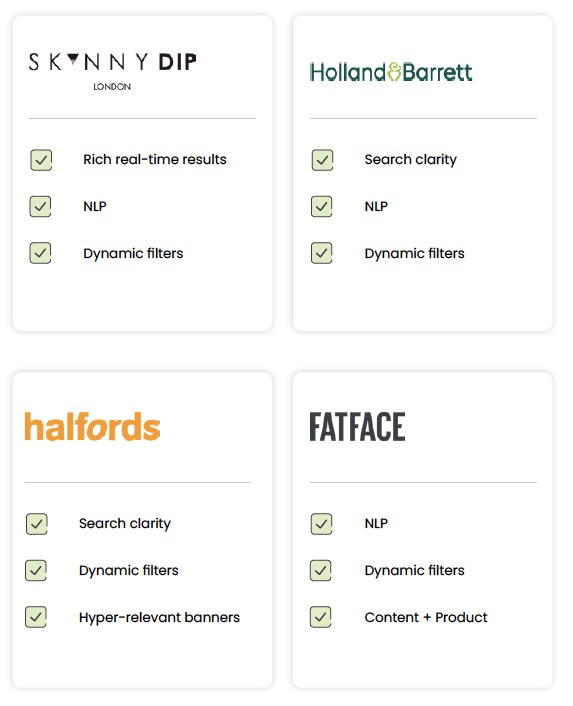

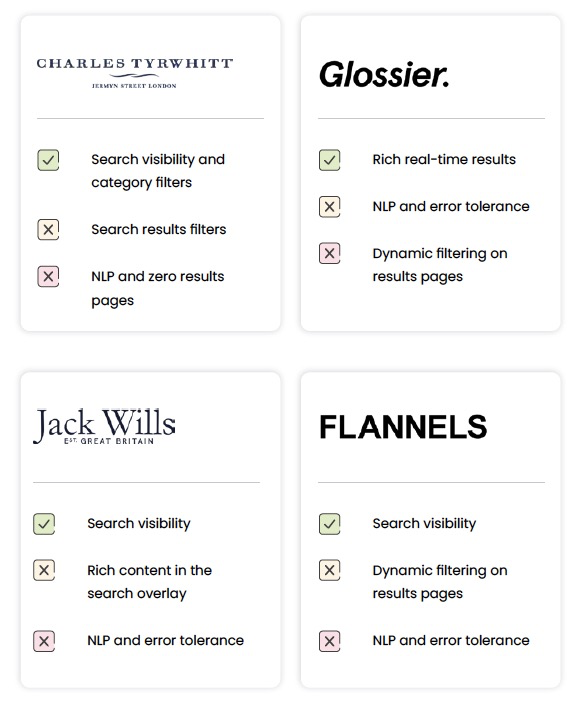

A dozen retailers researched performed very well in the Natural Language criteria including Cox & Cox, Skinny Dip, Vashi, Soak & Sleep, Made.com and Brastop. A handful of retailers performed very well also, but only on the type ahead search overlay, including Lands End, Hobbycraft, Iceland Foods, Radley and Holland & Barrett.

Product discovery begins the moment shoppers come to a website. Even if they know exactly what they are looking for, shoppers are in discovery mode whether they use search or categories to navigate.

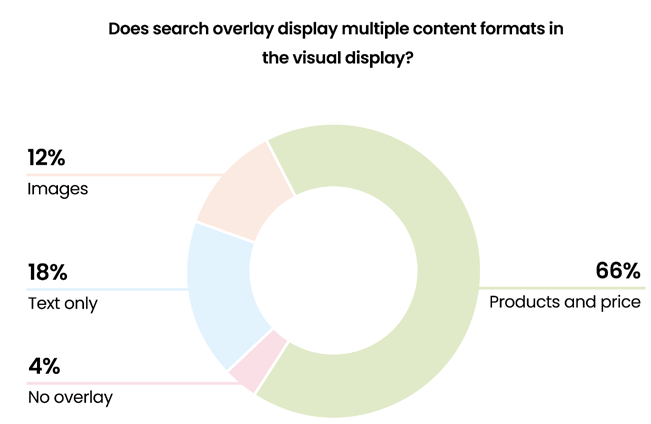

According to The Baymard Institute, some key mistakes can be made which harm the usability of search-as-you-type overlays. In our research, in the search overlay, type ahead search was only able to display exact match results on 22% of websites. 78% of websites returned irrelevant or broad match results, which may be causing more harm than help.

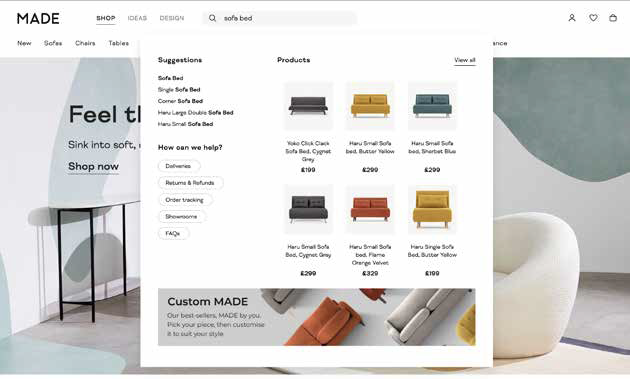

For type ahead search, also known as the search overlay, 66% of retailers displayed rich content including text, suggested search terms, product images, pricing and promotions. By displaying rich content that displays in realtime search can be used as a product discovery tool to encourage browsing behaviour, as well as high-intent search. Non-fashion brands are more likely to display pricing information on the search overlay than non-fashion retailers. Iceland was the only retailer to display ‘add to basket’ buttons on the search overlay.

Type ahead at it’s best - Klevu case study

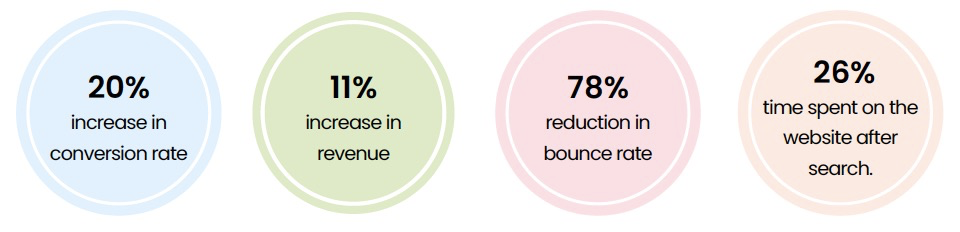

OCO Glasses use Klevu-native functionality that actually offers faceted navigation on the type ahead search overlay. It’s a beautiful discovery experience and helped result in a 20% increase in conversion rate, increase in revenue by 11% and counting and 78% reduction in bounce rate, and increase of 26% time spent on the website after search.

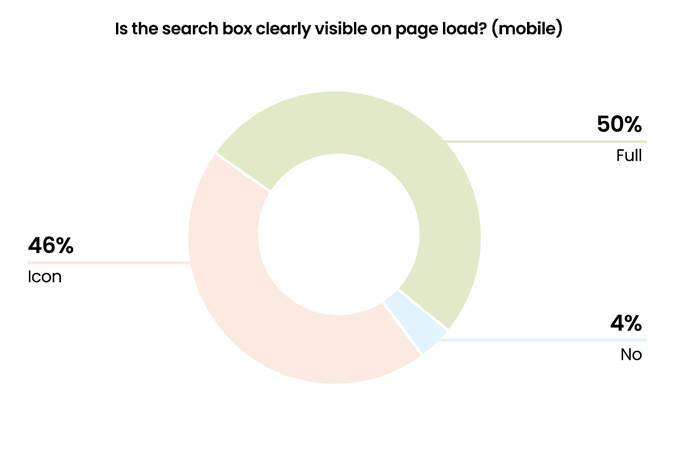

Exposing the search bar on mobile drives more shoppers to use search. So, it’s still surprising that only half of retailers are doing it. What’s more, 4% of retailers actually hide the search box within the menu on mobile devices.

Multi-brand retailers are more likely to display the full search bar in the sitewide header on mobile devices with two thirds of them doing so compared to just a third of brands. This isn’t surprising as many single brand retailers design their navigation to usher shoppers through the categories. On desktop a similar trend -- 92% of multi-brand retailers display the full search bar in the site-wide header, compared to 69% of brands.

Making search the best possible discovery journey is not just beneficial for shoppers, it provides retailers with relevant intent data to personalise even anonymous visits.

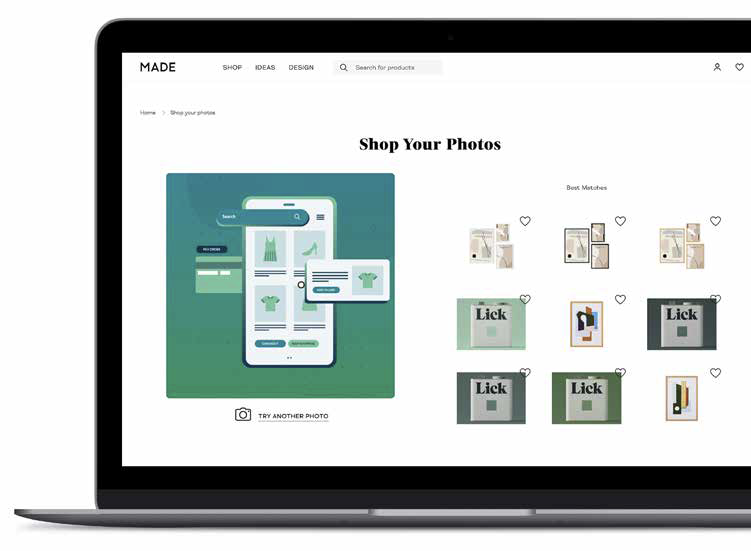

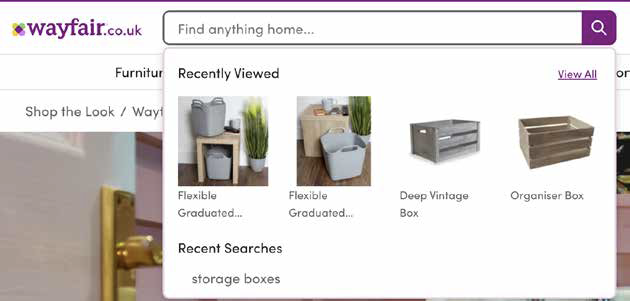

Only two retailers of the 50 we researched had an image search available on their websites - Made.com and Wayfair. Both retailers frame the experience well. Surprisingly, none of the fashion retailers researched had this functionality. In fact, Boohoo and Missguided scored quite low on search-related criteria in general.

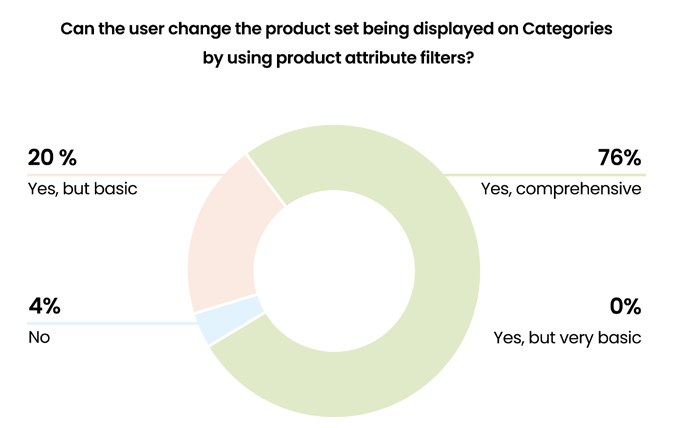

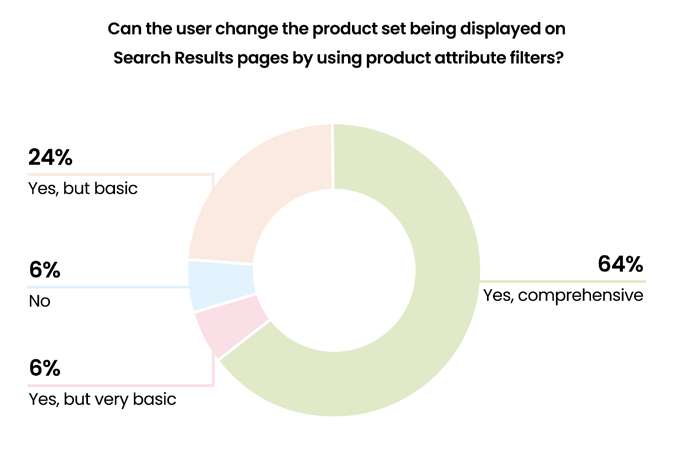

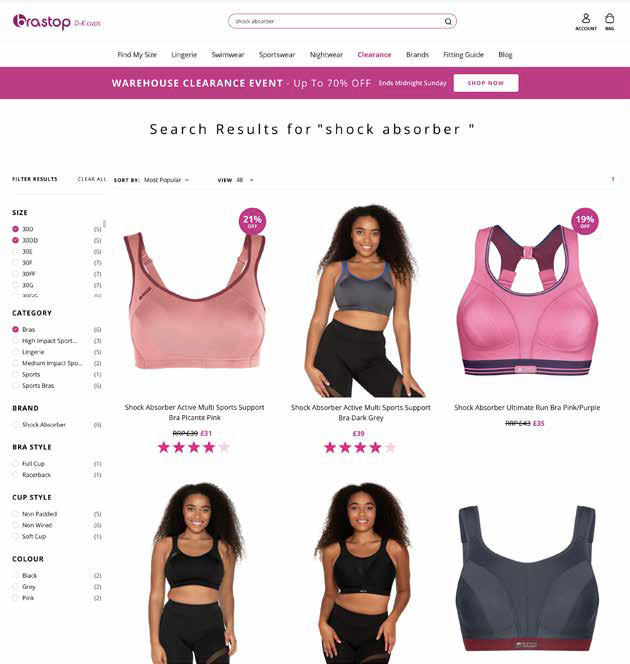

Offering a comprehensive set of filters on product listing pages will help shoppers find what they are looking for. 6% of retailers don’t offer any filtering on search results pages. 64% offered comprehensive filtering options on search results pages compared to 76% that offered it on category pages.

This shows that product attributes are not being clearly linked to dynamic filters. It is best practice to keep the navigation dynamic and display relevant comprehensive filters on search results and category pages. A few retailers' filters allowed for zero results after filtering too far.

It is best practice to keep the navigation dynamic and display relevant comprehensive filters

Just under a handful of retailers researched performed very well on the Discovery & Usability section including Made.com, Brastop, Bensons for Beds and Soak & Sleep.

Website personalisation has been challenging for retailers to do well. Even Amazon has struggled to pop the ‘filter bubble’ at times. Many retailers think they are personalising, but in fact they are using assumption-based marketing to segment shoppers. True personalisation is based on intent and relevance.

According to Internet Retailing, in sectors such as Beauty and Fashion, two thirds of shoppers say they are more likely to buy from sites that provide relevant product recommendations.

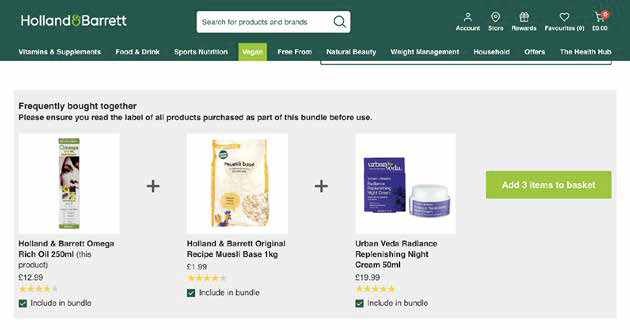

In our research, most retailers displayed some kind of product recommendations on product detail pages or product listing pages including recently viewed, complementary products, alternative products and more. According to Marketing Sherpa research, the most profitable type of product recommendation to display is the ‘Shoppers who viewed this also viewed’ which accounts for 68% of total revenue from recommendations.

If product recommendations are personalised, retailers should ensure that there is complete transparency in order to build trust with shoppers. For example, a ‘Recommended for you’ section may convert better if it’s explaining to the user ‘it’s available in your size’ or ‘because shoppers who viewed this went on to buy these’. Bundled products work well and are also common.

Recent research from Adobe cited that 34% of frequent shoppers are more likely to shop more if the website shows them products based on their past purchase history. What we find is that it’s best to not only look at past purchase history, but also add in the behavioural layer and use intent data driven by the search engine.

34% of frequent shoppers are more likely to shop more if the website shows them products based on their past purchase history.

Integrating your on-site search engine with your recommendations engine is the most reliable, efficient and profitable way to personalise product recommendations on eCommerce websites.

Best product discovery experience

Made.com is a simply beautiful website featuring useful and pretty product discovery journeys. Made.com is one of the only retailers offering image search, and it’s a pleasure to use. The type ahead search overlay features rich content and the sophisticated natural language processing means that shoppers are presented with highly relevant results using complex queries.

Runner up

Brastop is a highly usable website that uses rich product information to enrich the customer experience, especially on the product listing pages. The search is highly visible on both mobile and desktop and makes it clear what shoppers can search for. The relevancy of the search overlay and the results make it a pleasure to browse.

Honourable mentions

We’ve come a long way since “Ask Jeeves”. And really, today’s innovations are only the beginning too. What’s clear from this research is that many major retailers need to up their game when it comes to how usable their eCommerce experiences are for shoppers now and in the future.

According to The Baymard Institute, Amazon’s product discovery experience is leading the pack. It’s no wonder that Amazon’s eCommerce conversion rate is 13% and up to 75% with Prime members. Those numbers are big, really big. But not unattainable for other businesses.

First, optimise your on-site search experience to get as many shoppers using it as possible. This will not only increase your eCommerce conversion rate by 4-6x, it will also give you access to the most valuable and sustainable data - shopper intent.

Optimise your on-site search experience to get as many shoppers using it as possible.

Next, ensure that your on-site search engine is capable of showing relevant results whatever the shopper is searching for and whatever method they are using to search.

Then, use the data from search, browsing behaviour and purchases to influence product ordering and dynamic filters on product listing pages and optimise all of your product recommendations blocks.

It sounds complicated, and it is. But it’s easy with the right tools.

Screen Pages is a full service eCommerce agency that focuses on delivering leading edge eCommerce solutions for merchants and companies interested in digital innovation, transformation, and online growth.

Our clients include fashion, lifestyle, B2B & B2C brands with an appetite for growth and innovation.

Screen Pages are a team of eCommerce Professionals, wholly located in Surrey, UK.

We understand the importance of close-knit teams and fluid communication channels both internal and with third parties when building complex projects.

This is particularly important when it comes to problem solving which will be the true test of how proficient an agency is in website development.

Screen Pages has been a professional eCommerce agency for over 20 years.

Download the PDF now.